|

| FTX Logo (17) |

Abstract:

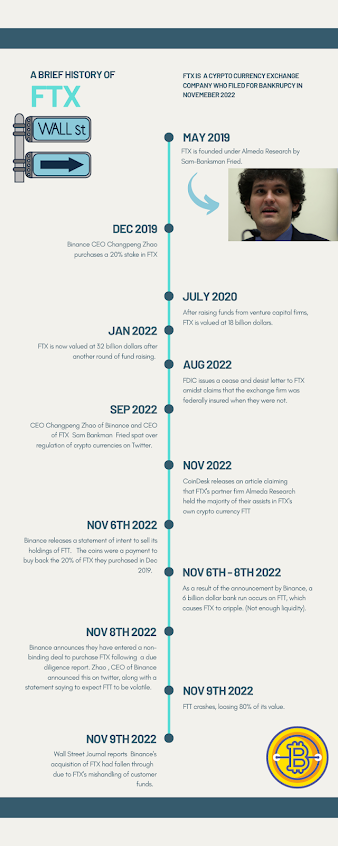

It’s a quiet morning in 1945, George Bailey opens Bailey Brother’s Bank and Loan for the day ahead. All is well until the unexpected happened. Swarms of customers come running into the bank demanding their money to be withdrawn from the bank. George is stunned, he doesn’t have enough money in the bank to pay out to everyone. What’s happened is a classic bank run, something everyone in the industry dreads. Although, these events are entirely fictional taking place in Christmas classic “It’s a Wonderful Life”, the threat of a bank run is very real. On November 6th, 2022, the unexpected happened and crypto exchange giant FTX’s coin “FTT” lost 80% of its value causing a six-billion-dollar bank run on the firm, crippling it in the process. This paper will delve into if FTX operated in an ethical manner, using four different principles: Individualism, Utilitarianism, Kantianism, and Virtue Theory.

Background of FTX:

FTX’s

journey from a small exchange within a separate finance company, Alameda

Research to the fastest growing crypto exchange in the world to a smoking wreck

is rocky one. Founded in 2019 by Sam Bankman-Fried, FTX began its slow climb as

a subsidiary of Alameda Research, an investment firm. Sam, the founder, and CEO

got to work, raising capital for his fledgling company through venture

capitalists. By July of 2020 FTX was valued at eighteen billion dollars, fast

forward two years, thirty-two billion dollars. One important early investor in

the company was Binance CEO, Changpeng Zhao. He bought a twenty percent stake

in the company. From its founding to August of 2022, FTX grew exponentially. In

March of 2021, FTX bought the naming rights to the Miami Heat’s stadium. By

2022 it was the second biggest crypto currency exchange in the world, only

surpasses by Changpeng Zhao’s company, Binance. Importantly, FTX bought back

the share’s Zhao purchased using a crypto currency they created, FTT. FTT is

used by FTX to fulfill customer’s exchanges of currency on their platform. As

an exchange FTX’s business model is to serve as a middleman between one form of

currency and another. Simply put, “A cryptocurrency exchange is simply where

buyers and sellers can trade crypto. If you want to trade crypto, you need to

do it via a crypto exchange” (10). This leads to the events that took place in November

2022.

The controversy:

In

the early hours of November 2nd, 2022, CoinDesk a popular website that covers

the cryptocurrency market released an article on Alameda Research the company

from which FTX was founded. Within the article it was revealed that Alameda

Research held nearly fifteen billion dollars’ worth of assets. Of that fifteen

billion about eight billion dollars was in FTX’s coin FTT. As another crypto

currency CEO and expert Cory Klippsten puts it, “It’s fascinating to see that

the majority of the net equity in the

Alameda business is actually FTX’s own centrally controlled and

printed-out-of-thin-air token)(2). What is important about this revelation is

that according to FTX themselves, there is only five billion dollars’ worth of

FTT coin in circulation, yet on Alameda’s books they had eight billion dollars’

worth of the coin. Zhao who was previously paid FTT for his twenty percent of

FTX announced his was selling all FTT in his company’s possession not long

after the article came out. The combination of the imbalances on the sheets and

Zhao’s announcement caused the value of FTT to plummet, losing nearly eighty

percent of its value in the following days of the article being released. On

top of that, Sam Bankman- Fried’s FTX had more to worry about, a classic bank

run. The New York times described the event as a, “ sudden cataclysm [that]

prompted comparisons to the collapse of Lehman Brothers, the investment bank

whose implosion helped set off the 2008 financial crisis.”(12). Much like

the big banks going under in 2008 crisis, the crypto giant looked for a

bailout. This bailout tentatively came from Changpeng Zhao and Binance. Zhao,

Binance’s CEO went to twitter to say, “This afternoon, FTX asked for our help.

There is a significant liquidity crunch. To protect users, we signed a

non-binding LOI, intending to fully acquire http://FTX.com” (14). He also added that the company

would be doing its due diligence into FTX before finalizing any deal. It was a

good thing that Zhao did so, as what was uncovered was that FTX had been

mishandling funds associated with customers. According to Fox Business an FTX

lawyer was quoted to saying, “Bankman-Fried used the firm as his "personal fiefdom". (13). Unsurprisingly,

the deal between FTX and Binance fell through, and on November 11th

FTX, along with Alameda Research filed for bankruptcy. Bankman-Fried went to

twitter to say,” I'm sorry.

That's the biggest thing. I f**ked up and should have done better.” (3). Following

this announcement Sam stepped down from CEO of FTX and

John J. Ray

III who handled Enron’s bankruptcy in 2001 stepped up to helm the company. John

after looking at the company financials stated, “Never in my career have I seen such a complete failure of

corporate controls and such a complete absence of trustworthy financial

information as occurred here” (Fox) As of the writing of this paper, FTX owes,

“its creditors at least $3.1 billion, according

to court documents filed by the bankrupt cryptocurrency exchange” (5).

Stakeholders:

|

| Timeline of Events |

|

| Sam Bankman Fried (15) |

|

| Timeline Part II |

Sequoia Capital

and other investment firms: Invested funds in FTX, with the bankruptcy are

likely to get pennies on the dollar of their investments.

Alameda

Research: Sister Company to FTX. Very closely related, is also tied up in

bankruptcy process

Individuals:

Everyday users of the platform. Likely to have lost their funds they had with

FTX if they did not withdraw in time. All users of the platform are due to be compensated

if funds can be found.

Individualism:

An

individualistic perspective on how FTX operated would show that they failed.

Individualism argues for the business and its owners to maximize its own

profits and gains. With a net worth of over fifteen billion dollars before the

collapse of FTX, Sam Bankman-Fried was one of wealthiest crypto investors in

the world, not to mention straight up one of the wealthiest people in the

world. After FTX went under due to the negligence of the company he, is

currently valued at just over one billion dollars (11). The management of the

firm was not in line with their own gain as it resulted in the company going

belly up.

FTX was poorly operated. The company routinely

inflated FTT’s value, thereby raising its own value, as they operated the coin

and had control of the flow of it. While this tactic worked in the short term,

once the Coinbase article came out the value of FTT sank, bankrupting FTX. Essentially

FTX shot themselves in the foot and was short sighted in their business strategy,

the opposite of serving themselves. The market that FTX was in is essentially

unregulated. Crypto currency is an extremely new concept, and governments have

not caught up to the times. This left FTX with essentially unlimited avenues to

succeed. Unfortunately, they built as Fox Business described them, “A house of Cards”

(7). FTX couldn’t even save itself, let alone their customers failing to follow

individualism.

Utilitarianism:

Under the guise of Utilitarianism, FTX’s actions are not

acceptable. Utilitarianism demands that the majority is “happy” under all

circumstances. The classic movie trope of the protagonist exclaiming “It’s for

the greater good!” is a perfect example of Utilitarianism in action. In the

case of FTX, they failed everyone. Due to their negligence over two billion

dollars of assets are unaccounted for, and three billion is owed to customers

and investors. Everyone the company effected was hurt by it in some way. No one

wants to lose money on an investment, and through the companies’ misguided hand

many people have. Others will get their money back, however, must go through the

company’s bankruptcy process to do so. This not only is a headache for these

investors but also could be costing them even more money due to legal fees and court

procedures. Utilitarian thought is fundamentally upside down with the state the

company is in. Employees are affected negatively without a job, investors and

investment firms are hurt as they have not lost a portion of their portfolio. Not

to mention, FTX has affected other investors and business with their recent

collapse.

FTX was the second largest crypto currency exchange in the world when they declared bankruptcy in November. This large of an exchange causes ripples in the crypto currency market. In financial terms, it will and did cause a downturn in the market in general. In fact, the crypto currency market has taken a hit in the last few weeks. Bitcoin the most popular crypto currency has dropped in price due to FTX’s bankruptcy. Time Investing reports, “Prior to FTX’s unraveling, bitcoin’s price was holding steady for most of October. Prices remained low at around $19,000 [per coin]” (8) Compare this with the price of Bitcoin as of December 1st, 2022, which is listed at just under seventeen thousand dollars per coin (10).

|

| Bitcoin's Price Dec.2 2022 (1) |

That is an eleven percent drop in value in just under a

month sense FTX has collapsed. Admittedly this is circumstantial evidence,

however a similar event occurred when the investment bank goliath Lehman

Brothers collapsed in the 2008 financial crisis. From the BBC, “The consequences for the world economy were extreme. Lehmans'

fall contributed to a loss of confidence in other banks, a worldwide financial

crisis and a deep recession in many countries” (4). FTX’s collapse has caused

mistrust in the market. This as a result creates a downturn in the market. This

downturn has affected an untold number of investors as small as individuals to

as large as firms. The majority has been affected more in a negative way than

the minority has. The rules of Utilitarianism have therefore been violated.

Kantianism:

Kantianism

argues that the means of actions are more important that the result of an

action. Not only this but the meaning behind the action is also equally

important. Kant described the meaning behind the action as “Good Will”. For a

business’s actions to be ethical permissible the actions the business takes

must be first good, and second their intention must also be good, or at least

neutral. In the case of FTX, the company’s bankruptcy isn’t the center of the

controversy, being merely a consequence of the company’s actions. FTX’s

management was poor. They took risks that were not necessary. Sam Bankman-Fried

was even quoted to saying, “I wasn't spending any

time or effort trying to manage risk on FTX” (6). Of course, this boils down to

downright negligent management of a multibillion-dollar corporation. Without

FTX releasing a statement as to why they took the actions they that inevitably

bankrupted them, it can only be left to speculation. One theory would show that

FTX violated Kantianism ethical procedure for pure greed of the company. FTX

was shown to purposely inflate the market value of FTT by selling a small

portion of the coin at a certain favorable price, then using that value to calculate

their net worth (7). An analogy by Ben McMillan shows the flaw in this method, “imagine someone owns every house in a 100-home neighborhood

and forces the sale of one home for $1 million, then uses that sale to show

they have $100 million in "equity." But then, the owner is forced to

sell all the remaining 99 homes, and the houses only sell for $100,000 each –

meaning $90 million of their so-called equity disappears” (7). By inflating

their net worth FTX could theoretically get more capital through loans, thereby

giving the company more cash. Ethically through the guise of Kant, this isn’t

permissible. It is misleading, FTX doesn’t have nearly the amount of equity as

they claim, instead they misled customers and investors by having the inflated

numbers on the books. This tactic is shady and impermissible by Kantian thought

as the means that the company used to get larger is misleading, automatically

violating Kant’s philosophy.

Virtue

Theory:

Virtue theory is an ethical theory that takes one’s character traits into account, to determine if one’s actions are ethical or not. Traits that help one flourish and grow as a person are good, or “virtues”. Whilst traits that hinder people’s growth and happiness are “vices”. Putting FTX under the microscope, they displayed both virtues and vices. Looking at Sam Bankman-Fried’s twitter shows the man at least at the public level is remorseful for what has occurred, and how it affected his customers; tweeting, “My goal—my one goal—is to do right by customers… after that investors. But first, customers” (3).

|

| Tweet from Sam Bankman-Freid (3) |

While this

is after the fact, he as the de facto head of the company does show willingness

to fix what he self admittedly blundered. Being virtuous after the fact, however,

does not make up for greed the company heads had before bankruptcy. As

previously stated, FTX had no risk management, it routinely pumped FTT’s value

increasing FTX’s on paper equity, and it also gave out messy loans to sister

firm, Alameda Research. The New York Times claims that FTX could have loaned as

much as 10 billion dollars to Alameda Research, much of that being customer

funds (9). Of course, investment bankers loan out money all the time, it is

their way of making money. However, the big difference here is that FTX’s ties

to Alameda Research made it so FTX heads made money too when Alameda Research

made money. FTX was greedy, it pushed risky investments and inflated their own

revenues to the point where when hardship hit in the form of FTT tanking in

price, the whole system collapsed around it. By falling to the vice, FTX doomed

itself, and its unethical practices tarnished the company. Even before the

collapse, other companies pulled out of loans with Alameda Research, which in

extension is FTX. For instance, the New York Times reported, “Blockchain.com, a leading seller of Bitcoin and other

cryptocurrencies, closed out a loan it had made to Alameda, concerned about

“too many illiquid-related assets” (9). At the end of the day companies exist

to make money, so it shows the risk that FTX and Alameda Research were taking

for one to pull out. The risk taken was backed only by the greed of the firm’s

leaders.

Justified

Ethics Evaluation:

FTX during its operation seemed too

good to be true, and as the adage goes, if it seems too good to be true it is. Being

the fastest growing exchange for crypto currency in the world is lucrative and

enticing. Figures like Sam Bank

man-Fried took the world by the reins, capitalized

on a budging market to make as much money as possible. The company clearly was

a personal piggy bank for Sam and his cronies. The company was run with a loose

cannon at the wheel, it is no wonder why it collapsed. Playing fast and loose

with billions of customers dollars shows no regard to one’s customers. As a

result, FTX is unable to pay back their customers and investors, loosing three

billion dollars’ worth of assets. Sam’s actions as CEO were downright negligent.

He ran FTX into the ground through his risky investments with Alameda and the

self-inflation of FTX’s main asset, FTT. It doesn’t take a genius in economics

to realize artificially pumping up the value of FTT would cause a market

correction eventually. This tactic was used by Jorden too Belfort, better known

as The Wolf of Wall Street with his investment firm, Stratton Oakmont. He

pushed his customers to buy cheap stock on mass, inflating the price of it. It's

out of pure greed to capitalize and make as much money as possible. Both firms

ended in the same fate, bankrupt. If FTX were to go back and redo their past,

they could easily be in business today if they didn’t do a measure of actions.

One; FTX needed to cease their grey area relations with Alameda Research. This

relationship in a non-crypto related market would’ve been under lots of

scrutiny from investors and regulatory agencies. Second, FTX needed to practice

ethical business practices, such as being honest about actual revenue, not

inflating their net worth through shady means. The mix of negligence and FTX’s

more dubious business practices marked their downfall. The company was

mismanaged to the point that they had no idea of the amount of liquidity they

had to pay debts owed. When FTX’s house of cards toppled, their customers paid

the price.

Conclusion:

FTX’s

bankruptcy comes as no surprise in hindsight. Under the scrutiny of four

different ethical theories, the company failed to show any sort of

ethical actions. It didn’t serve itself by making poor decisions that ended the

company, failing Individualism. The company did not serve the greater good

either, instead plunging the market into distress and hurting the wallets of

potentially millions of people. This breaks the rules of Utilitarianism. The company’s

actions were not out of the good will either, they mislead customers and

investors about the net worth of the company and thereby it’s security,

breaking the rules of Kant. FTX was also not virtuous, operating out of pure

greed, again pumping up its net worth and investing funds in risky bets. Truly,

the fall of FTX is a shame, not because the company itself was anything

particularly special, but the fall of FTX marks a new struggle in the crypto market

and may delay its adoption into the mainstream. The concept of crypto is

heavily intertwined in what experts are calling the “Internet 3.0” and this

fall may falter a new renaissance in the development of the internet and

humanity as whole.

References

1. (n.d.). CoinDesk.

<a

href='https://www.coindesk.com/price/bitcoin/'>https://www.coindesk.com/price/bitcoin/</a>

2. Allison, I.

(2022, November 2). Divisions in Sam Bankman-Fried’s Crypto Empire Blur on

His Trading Titan Alameda’s Balance Sheet. CoinDesk. <a

href='https://www.coindesk.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-trading-titan-alamedas-balance-sheet/https://www.coindesk.com/business/2022/11/02/divisions-in-sa'>https://www.coindesk.com/business/2022/11/02/divisions-in-sam-bankman-frieds-crypto-empire-blur-on-his-trading-titan-alamedas-balance-sheet/https://www.coindesk.com/business/2022/11/02/divisions-in-sa</a>

3. Bankman-Freid,

S. (n.d.). Twitter. <a href='https://twitter.com/SBF_FTX'>https://twitter.com/SBF_FTX</a>

4. Blythe, N.

(2010, September 15). How did Lehman's collapse affect the world of finance?. BBC.

<a

href='https://www.bbc.com/news/business-11310143'>https://www.bbc.com/news/business-11310143</a>

5. Brooks, K. J.

(2022, November 21). Bankrupt FTX Trading owes creditors more than $3 billion. CBS

News. <a

href='https://www.cbsnews.com/news/ftx-bankruptcy-3-billion-crypto-sam-bankman-fried/'>https://www.cbsnews.com/news/ftx-bankruptcy-3-billion-crypto-sam-bankman-fried/</a>

6. Dean, G. (2022,

December 1). Sam Bankman-Fried said that if he'd spent 'an hour a day' thinking

about risk management FTX might not have collapsed. Yahoo Entertainment.

<a href='https://www.yahoo.com/entertainment/sam-bankman-fried-said-hed-131733118.html?fr=sycsrp_catchall'>https://www.yahoo.com/entertainment/sam-bankman-fried-said-hed-131733118.html?fr=sycsrp_catchall</a>

7. Dumas, B.

(2022, November 23). FTX: How Sam Bankman-Fried built a house of cards. Fox

Business. <a href='https://www.foxbusiness.com/markets/ftx-sam-bankman-frieds-house-cards-came-tumbling-down'>https://www.foxbusiness.com/markets/ftx-sam-bankman-frieds-house-cards-came-tumbling-down</a>

8. Gailey, A.,

& Cabello, M. (2022, December 2). Bitcoin’s Price Remains Low as FTX

Contagion Continues. How Investors Should React. Time. <a

href='https://time.com/nextadvisor/investing/cryptocurrency/bitcoin-crash-continues/#:~:text=Despite%20the%20ups%20and%20downs%2C%20bitcoin%E2%80%99s%20price%20has,winding%20down%20pandemic%20measures%20to%'>https://time.com/nextadvisor/investing/cryptocurrency/bitcoin-crash-continues/#:~:text=Despite%20the%20ups%20and%20downs%2C%20bitcoin%E2%80%99s%20price%20has,winding%20down%20pandemic%20measures%20to%</a>

9. Goldstein, M.,

Stevenson, A., Farrell, M., Yaffe-Bellany, D. (2022, November 18). How FTX’s

Sister Firm Brought the Crypto Exchange Down. New York Times. <a

href='https://www.nytimes.com/2022/11/18/business/ftx-alameda-ties.html?action=click&module=RelatedLinks&pgtype=Article'>https://www.nytimes.com/2022/11/18/business/ftx-alameda-ties.html?action=click&module=RelatedLinks&pgtype=Article</a>

10. How Does a

Crypto Exchange Work? (2022, September 23). Sofi Learn. <a

href='https://www.sofi.com/learn/content/how-crypto-exchanges-work/'>https://www.sofi.com/learn/content/how-crypto-exchanges-work/</a>

11. Morrow, A.

(2022, November 10). Crypto’s white knight lost 94% of his wealth in a single

day. CNN. <a href='https://www.cnn.com/2022/11/09/business/sam-bankman-fried-wealth-ftx-ctrp/index.html'>https://www.cnn.com/2022/11/09/business/sam-bankman-fried-wealth-ftx-ctrp/index.html</a>

12. Yaffe-Belany,

D., & Grithiff, E. (2022, November 8). Crypto World Is Rocked as World’s

Largest Exchange Rescues Rival. New York Times. <a

href='https://www.nytimes.com/2022/11/08/technology/binance-ftx-deal-crypto.html'>https://www.nytimes.com/2022/11/08/technology/binance-ftx-deal-crypto.html</a>

13. O'Halloran, S.

(2022, November 28). FTX bankruptcy unique, losses hard to determine: Ken

Feinberg. Fox Business. <a

href='https://www.foxbusiness.com/markets/ftx-bankruptcy-unique-losses-hard-to-determine-ken-feinberg'>https://www.foxbusiness.com/markets/ftx-bankruptcy-unique-losses-hard-to-determine-ken-feinberg</a>

14. Zhao, C.

(n.d.). Twitter . https://twitter.com/cz_binance

15. Sam Bankman-Fried Image (n.d.). https://miningtechnology.in/sam-bankman-fried-denies-fraud-in-ftx-collapse-rolling-stone/

16. Changpeng Zhao Image (n.d.). https://noticierobitcoin.net/noticia/changpeng-zhao-traders-binance-eludir-bloqueo-estados-unidos/

No comments:

Post a Comment